HFM Malaysia

Home

Trading Platform Overview

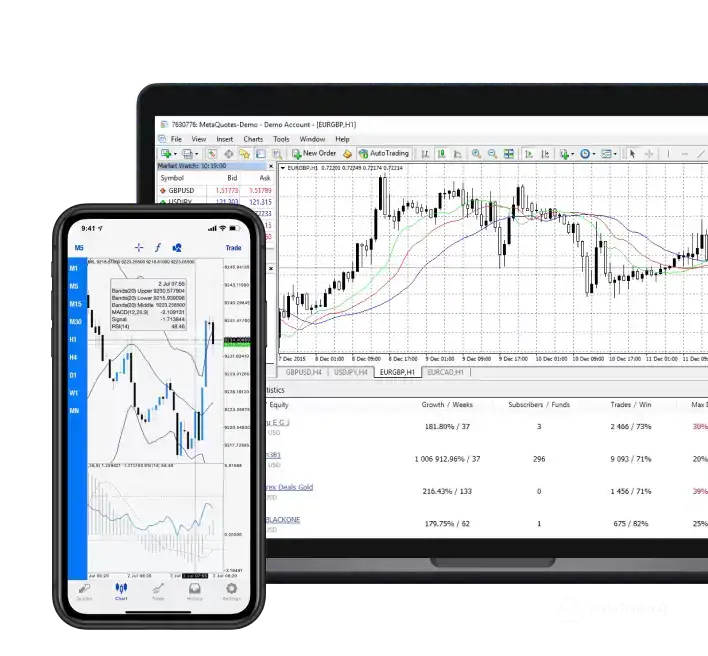

HFM provides comprehensive trading services through multiple platforms including MetaTrader 4, MetaTrader 5, and proprietary HFM mobile applications. These platforms offer access to over 500 tradeable assets including forex pairs, cryptocurrencies, stocks, indices, and commodities. The platform maintains licenses from major regulatory authorities including FCA, CySEC, and DFSA, ensuring client fund protection and operational transparency.

The platform incorporates negative balance protection and segregated client accounts as standard security measures. Through integration with major liquidity providers, HFM delivers competitive spreads starting from 0 pips on certain account types. Advanced charting capabilities and technical analysis tools are available across all platforms.

Available Trading Platforms

- MetaTrader 4 (Desktop, Web, Mobile)

- MetaTrader 5 (Desktop, Web, Mobile)

- HFM Mobile Application

- Multi-Terminal Platform

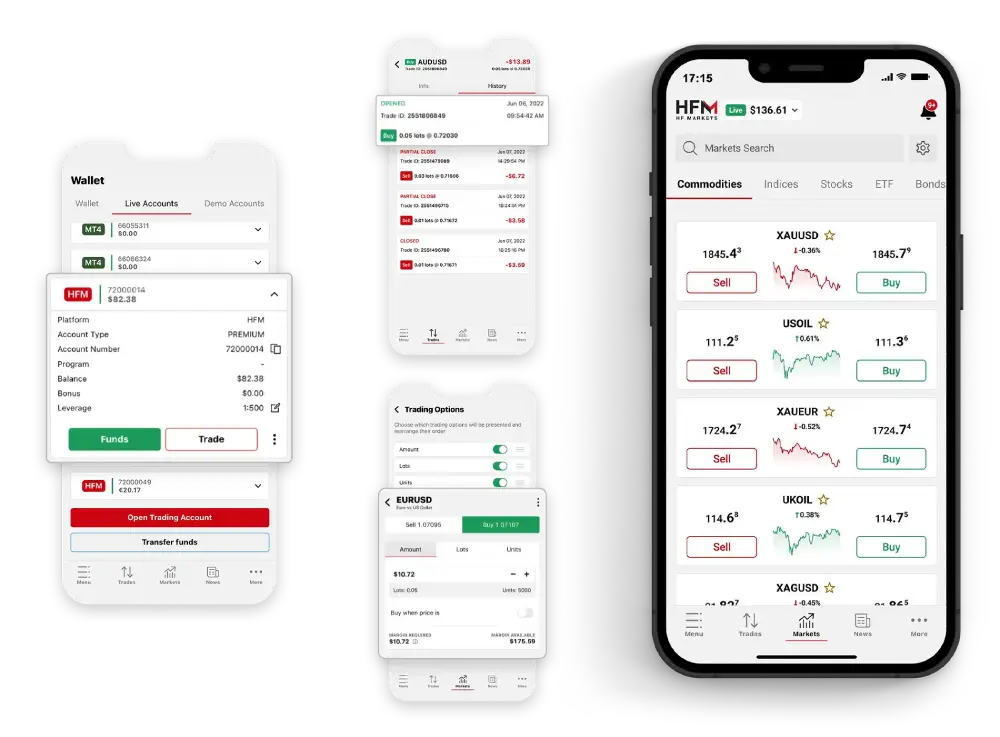

Account Types and Requirements

HFM offers several account categories designed for different trading preferences and experience levels. The minimum deposit requirement starts from $0, with leverage up to 1:2000 available depending on the account type and asset class. Each account provides specific features and trading conditions optimized for particular trading styles.

Account verification follows standard KYC procedures and requires government-issued identification documents. The verification process typically completes within 24-48 hours, allowing full access to trading functionality and withdrawal capabilities.

Main Account Categories

HFcopy Account

- Minimum deposit: $100

- Copy trading functionality

- Maximum leverage 1:500

- Social trading features

Zero Account

- Minimum deposit: $200

- Raw spreads from 0

- Maximum leverage 1:2000

- Commission per lot

Premium Account

- Minimum deposit: $10

- Spreads from 1.2 pips

- Maximum leverage 1:2000

- No commission

Platform Security and Regulation

Multiple tier-1 regulatory authorities oversee HFM operations, ensuring compliance with international financial standards. Client funds are maintained in segregated accounts at major global banks. The platform implements SSL encryption for data protection and secure transaction processing.

Regular external audits verify compliance with regulatory requirements and internal control systems. Risk management protocols include automatic margin monitoring and negative balance protection for all retail clients.

Regulatory Licenses

- Financial Conduct Authority (FCA)

- Cyprus Securities and Exchange Commission (CySEC)

- Dubai Financial Services Authority (DFSA)

- Financial Sector Conduct Authority (FSCA)

- Financial Services Commission (FSC)

Trading Instruments and Markets

The platform provides access to more than 500 tradeable instruments across multiple asset classes. Currency pairs include major, minor and exotic combinations with competitive spreads. Cryptocurrency CFDs cover major digital assets including Bitcoin, Ethereum and others. Stock indices from major global markets are available for trading.

Metal trading includes gold, silver and other precious metals against various currencies. Energy commodities such as crude oil and natural gas are accessible through CFD instruments. Bond trading covers government securities from multiple countries.

Available Asset Classes

- 50+ Currency Pairs

- 40+ Cryptocurrencies

- 95+ CFDs

- Global Stock Indices

- Precious Metals

- Energy Commodities

- Government Bonds

Trading Conditions

Trading conditions vary by account type and asset class, with competitive spreads available across all instruments. Order execution occurs through direct market access with no dealing desk intervention. Multiple order types support various trading strategies.

The platform allows hedging, scalping and automated trading through expert advisors. Market depth information and advanced charting tools assist in technical analysis and trade planning.

Key Trading Features

- Spreads from 0 pips

- Leverage up to 1:2000

- No requotes

- Instant execution

- Multiple order types

- Expert Advisor support

Technical Analysis Tools

The platform integrates comprehensive technical analysis capabilities across all trading interfaces. Advanced charting packages include multiple timeframes and over 50 technical indicators. Drawing tools support detailed pattern analysis and trade planning. Real-time market data feeds provide accurate price information for informed decision-making.

Custom indicator development capabilities allow traders to implement specialized analysis methods. Integration with third-party analysis tools expands available technical resources.

Payment Methods

Multiple deposit and withdrawal options are available through secure payment channels. Processing times vary by method, with electronic payments typically completing within 24 hours. Cryptocurrency transactions provide additional flexibility for international clients.

The platform maintains strict verification requirements for withdrawals to ensure security. Minimum withdrawal amounts apply based on the payment method selected.

Available Payment Options

Bank Transfer

- Processing time: 2-7 business days

- Minimum deposit: $100

- No deposit fees

Credit/Debit Cards

- Processing time: Instant

- Minimum deposit: $5

- Major cards accepted

Electronic Payments

- Processing time: 24 hours

- Multiple providers available

- International support

Analysis Features

- Multiple chart types

- 50+ technical indicators

- Pattern recognition tools

- Market depth analysis

- Economic calendar

- Custom indicators support

Mobile Trading Capabilities

The HFM mobile application provides full trading functionality on iOS and Android devices. Real-time synchronization maintains consistent account information across all platforms. The mobile interface supports complete account management including deposits and withdrawals.

Security features include biometric authentication and encrypted communications. Push notifications keep traders informed of market movements and account activities.

Mobile Features

- Full trading functionality

- Real-time price updates

- Account management

- Secure authentication

- Push notifications

- Cross-platform synchronization

Operational Requirements

Platform access requires stable internet connectivity and compatible devices. Minimum system requirements ensure optimal performance. Regular platform updates maintain security and functionality.

Account maintenance requires adherence to terms of service and regulatory requirements. Active accounts must maintain minimum balance requirements based on account type.

System Requirements

- Windows 7 or higher

- macOS 10.12 or higher

- 4GB RAM minimum

- Stable internet connection

- Compatible mobile devices

Customer Support Services

Support services operate 24/5 through multiple communication channels. Response times for general inquiries average under 24 hours. Technical support specialists assist with platform-related issues. Financial department handles payment and account queries.

Documentation and educational resources provide additional assistance. Regional support teams offer service in multiple languages.

Support Channels

- Email support

- Live chat

- Support tickets

- Regional phone support

- Documentation center

Review Analysis Data

| Aspect | Average Rating | Common Issues | Resolution Status |

| Platform Stability | 3.8/5 | Connection delays, chart freezing | Ongoing optimization |

| Account Access | 3.5/5 | Verification delays, blocking issues | Case-by-case review |

| Withdrawal Process | 3.7/5 | Processing time, documentation | Standard procedures |

| Customer Support | 3.9/5 | Response time, resolution speed | Service expansion |

| Trading Conditions | 4.1/5 | Spread variations, execution | Market dependent |

Frequently Asked Questions

Account verification requires government-issued identification, proof of residence dated within 3 months, and additional documents based on account type and jurisdiction requirements.

Standard withdrawal processing occurs within 24-48 hours after approval. Bank transfers may require 2-7 business days. Cryptocurrency withdrawals typically complete within 24 hours.

Technical support assists with position verification and resolution. The platform maintains transaction logs for verification. Compensation may apply for documented system-related issues affecting trades.