About Us

Home » About

Corporate Foundation

HFM established operations in 2010, beginning as HotForex in the global financial markets. The organization developed comprehensive trading services supporting multiple asset classes and trading platforms. Malaysian operations expanded through dedicated regional support and localized trading conditions.

Development Timeline

- 2010: Initial establishment

- 2015: Asian market entry

- 2020: HFM rebranding

- 2022: Malaysian expansion

- 2024: Technology enhancement

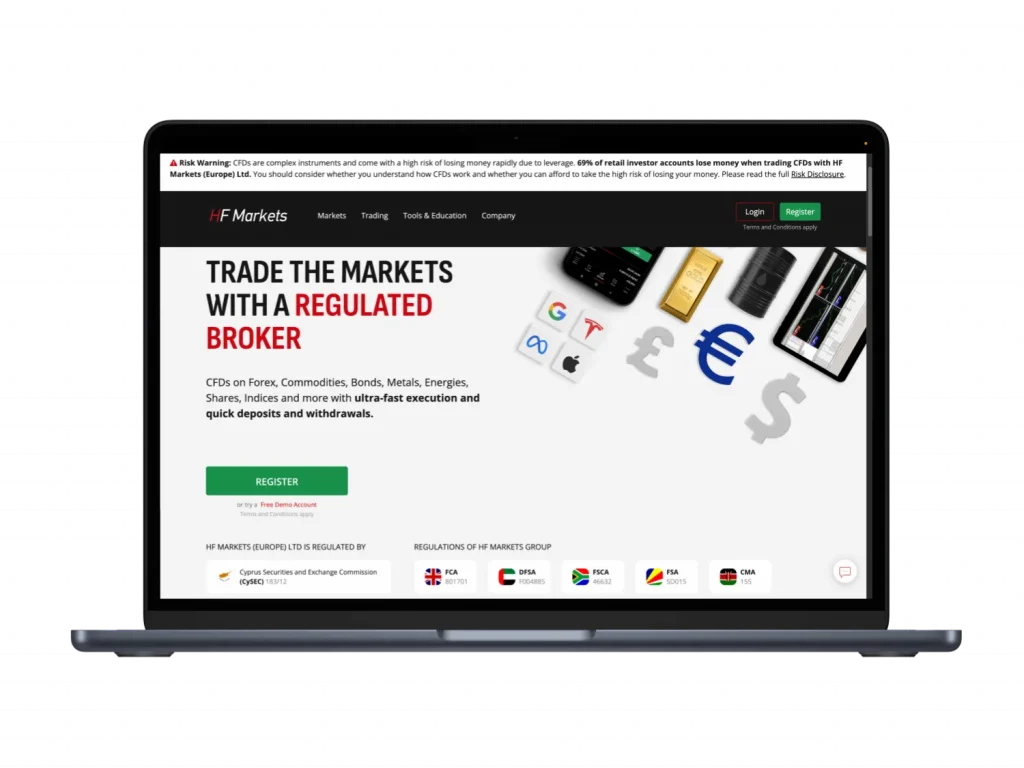

Regulatory Framework

Multiple regulatory authorities oversee HFM operations ensuring client protection and operational compliance. Licensing requirements maintain strict operational standards across all service areas. Malaysian clients receive protection through comprehensive regulatory oversight.

Regular audits verify compliance with international standards. Security protocols protect client funds through segregated accounts and monitoring systems.

Regulatory Authorities

Primary Regulators

- Financial Conduct Authority (FCA)

- Cyprus Securities and Exchange Commission (CySEC)

- Dubai Financial Services Authority (DFSA)

Additional Oversight

- Financial Sector Conduct Authority (FSCA)

- Financial Services Commission (FSC)

- Regional regulatory bodies

Operational Structure

HFM maintains comprehensive operational infrastructure supporting global trading services. Dedicated departments ensure efficient service delivery across all platforms. Support systems operate continuously during market hours.

Technology infrastructure provides stable trading environments through multiple platforms. Security systems protect client information and trading operations.

Organizational Divisions

| Department | Function | Service Areas |

| Executive | Strategic management | Corporate direction |

| Operations | Platform maintenance | Trading systems |

| Support | Client assistance | Technical help |

| Compliance | Regulatory adherence | Legal requirements |

| Technology | System development | Platform enhancement |

Corporate Values

HFM emphasizes operational transparency and client service excellence. Professional standards guide all organizational activities. Corporate culture supports continuous improvement and innovation.

Employee development programs maintain service quality standards. Client feedback drives service enhancement initiatives.

Core Principles

- Operational integrity

- Service excellence

- Innovation focus

- Client protection

- Professional development

Global Infrastructure

HFM maintains extensive global infrastructure supporting continuous trading operations across international markets. Regional offices provide localized services through dedicated facilities equipped with advanced trading and support systems. The infrastructure network encompasses multiple continents ensuring consistent service delivery.

Technological implementation includes redundant systems and backup facilities maintaining operational stability. Each regional center operates under specific regulatory requirements while maintaining global operational standards. Malaysian operations integrate with global infrastructure through dedicated regional connections.

Operational Centers

| Center Type | Primary Functions | Service Coverage |

| Trading Hubs | Market execution, Data processing | 24/5 operation |

| Support Centers | Client assistance, Technical support | Regional hours |

| Data Facilities | Information storage, System backup | Continuous |

| Training Centers | Staff development, Client education | Scheduled |

| Regional Offices | Local operations, Compliance | Business hours |

Infrastructure Components

Trading Facilities

- Advanced execution systems

- Real-time market access

- Data processing centers

- Backup trading platforms

- Emergency operations facilities

Support Infrastructure

- Client service centers

- Technical support facilities

- Documentation management

- Communication systems

- Regional coordination centers

Technology Centers

- Server facilities

- Network operations

- Security systems

- Development laboratories

- Testing environments

Client Protection

Security systems protect client accounts and trading operations. Multiple verification layers ensure account safety. Fund protection includes segregated accounts and monitoring systems.

Regular security updates maintain protection standards. Compliance systems verify operational integrity.

Security Measures

Account Protection

- Multi-factor authentication

- Access monitoring

- Transaction verification

Fund Security

- Segregated accounts

- Regular audits

- Protection systems

Technology Integration

Platform development incorporates advanced trading technologies. System architecture supports multiple trading platforms. Regular updates maintain technological standards.

Integration processes ensure system compatibility and performance. Development focuses on enhancement and optimization.

Technology Systems

- Trading platforms

- Security protocols

- Data management

- System monitoring

- Performance optimization

Market Access

Trading infrastructure provides comprehensive market access. Multiple asset classes available through integrated platforms. Execution systems ensure efficient order processing.

Liquidity providers maintain consistent market availability. Price feeds deliver real-time market information.

Trading Access

- Multiple platforms

- Asset variety

- Execution systems

- Market information

- Trading tools

Future Development

Strategic planning focuses on service enhancement and market expansion. Development priorities include technology advancement and service improvement. Malaysian market development continues through enhanced local services.

Innovation programs support continuous platform improvement. Client feedback guides development priorities.

Development Areas

- Platform enhancement

- Service expansion

- Technology integration

- Support improvement

- Market development